NRI Bank Account Guide: Everything About NRE, NRO, FCNR Accounts

If you are a non-resident living outside India and still have some connection with India, you’ll deal with Indian banking rules sooner or later. Many non-residents — NRIs, OCI/PIO card holders, and foreign individuals or entities — feel unsure about which NRI bank account suits them, what documents they need, how tax works, and how much money they can move in or out of India.

This guide clears those doubts. It explains all NRI bank account types you can open, such as NRO, NRE, FCNR, RFC, and SNRR, who can open which account, issues people face when rules aren’t followed, and other compliance-related points. It also covers areas that banks and advisors often don’t explain clearly, so you get the full picture before making decisions.

Disclaimer (Last updated: 21 November 2025): This article explains common rules and steps about NRI bank accounts in India. It is meant for general information only and is not legal, tax, or financial advice. Rules, fees and limits change often. Before you act on anything here, check the bank’s official pages and consult a qualified tax adviser or chartered accountant for your situation. We do our best to keep the content accurate, but we are not responsible for any loss or delay that may happen from using this guide.

Who This Guide Is For?

This guide suits:

- NRIs with Indian passports

- Foreign citizens with OCI cards

- Foreign citizens with older PIO cards

- Foreign nationals with no OCI or PIO card but with income or property in India

- Foreign companies that hold assets in India

Your category decides which Indian bank account you can open, how your money is taxed, and what papers the bank will ask for.

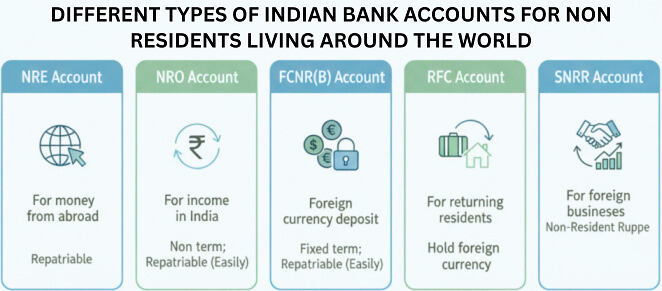

Types Of NRI Bank Accounts

Below is a simple table that you can refer to as a starting point before we go deeper.

| Account Type | What It Is | Who Can Open | Tax Treatment | Repatriation | Best Use |

|---|---|---|---|---|---|

| NRE Account | Rupee account for money sent from abroad | NRI, OCI, PIO | Interest normally not taxed in India | Full transfer allowed | Holding foreign-earned income in India |

| NRO Account | Rupee account for income earned in India | NRI, OCI, PIO, foreign nationals with Indian income | Interest taxed; TDS applies | Up to allowed yearly limit with paperwork | Rent, pension, dividends, property income |

| FCNR(B) Deposit | Fixed deposit in foreign currency | NRI, OCI, PIO | Interest normally not taxed in India | Full transfer allowed | Keeping money in foreign currency without rupee swings |

| RFC Account | Foreign currency account for returning residents | Returning NRIs | Tax depends on residency status | Free transfer allowed | Holding foreign currency after moving back to India |

| SNRR Account | Rupee account for specific foreign business activities | Foreign companies / foreign bodies | Tax depends on activity | Rules vary | Business operations in India |

Who Counts as NRI, OCI, PIO and Foreign National

An NRI is an Indian passport holder living overseas.

An OCI or PIO holder is a foreign passport holder of Indian origin.

A foreign national is any person who is not an Indian citizen but has income or assets in India.

Your category decides the account you can open, how the bank treats your money, and what papers they ask for.

Detailed Look at Each NRI Account Type

NRE (Non-Resident External) Account

This account is for foreign-earned money you bring to India. You can hold it as savings, current, or fixed deposit. Both principal and interest can be taken overseas without limits. Interest is normally not taxed in India. Some banks may limit cheque books or overdraft options, so check their details before opening.

NRO (Non-Resident Ordinary) Account

This account is for income earned in India after you become non-resident. This includes rent, pension, dividends, capital gains, and other income linked to India. Interest is taxed. Banks deduct TDS. You can move money abroad from this account, but there is a yearly limit and you need papers such as a CA certificate and proof of the source of funds.

FCNR(B) Deposit

This is a foreign-currency deposit kept in India. Your principal and interest stay in the same foreign currency, so you avoid rupee swings. You can move the funds overseas after maturity. Banks accept common currencies like USD, GBP, EUR, AUD, CAD, and others as per rules.

RFC (Resident Foreign Currency) Account

If you return to India for good, your non-resident status ends. You may shift certain foreign assets or FCNR deposits into an RFC account. This lets you keep money in foreign currency even after coming back.

Minor Accounts, Joint Accounts and Mandate Holders

Banks allow minor NRI accounts with specific signing rules. Joint accounts with resident Indians are allowed but can cause tax and transfer issues because resident and non-resident money cannot be treated the same. A mandate holder is a person in India who can handle simple tasks for you, like signing cheques or giving forms. They can’t move money outside India but can handle basic work.

Eligibility Rules and Who Can Open Each Type of Account

Banks follow FEMA guidelines to decide who can open NRE, NRO, or FCNR accounts. The rules differ by your status, your passport, and where you live. Understanding these rules helps you avoid delays and repeat paperwork.

NRE Account Eligibility

You can open an NRE account if you are:

- An Indian citizen living abroad

- An OCI card holder

- A PIO card holder (older scheme)

Foreign nationals who do not have Indian origin usually cannot open an NRE account. Your money must come from outside India to fund this account.

NRO Account Eligibility

You can open an NRO account if you are:

- An NRI with Indian income

- An OCI or PIO card holder with Indian income

- A foreign national with income in India such as rent, dividends, or property income

This account is suitable for any income that arises in India even if you live abroad or hold a foreign passport.

FCNR(B) Deposit Eligibility

FCNR(B) deposits are allowed for:

- NRIs

- OCIs

- PIOs

Foreign nationals can open FCNR(B) deposits only in limited cases. Most banks allow FCNR(B) only when the person is of Indian origin or meets specific RBI rules.

Special Country Rules

Residents of certain countries may face extra checks or may need special approvals. Banks also follow their own internal checks based on passport type, visa status, and the laws of your current country of residence.

How to Open an NRI Account from Abroad?

Opening an NRI account from outside India is not hard once you know the exact steps. Banks vary in their process, but most follow a similar pattern. Here is the clear path you can expect.

Step 1: Choose the Bank and Account Type

Pick between NRE, NRO, or FCNR(B) based on your income source. If your money comes from abroad, choose NRE. If your money comes from India, choose NRO. If you want to hold foreign currency, choose FCNR(B).

Step 2: Fill the Online Form

You can start the application on the bank’s website. Some banks complete the whole process digitally. Others ask for physical forms after online submission.

Step 3: Upload Scanned Documents

The common documents you will need are:

- Passport copy (photo page and address page)

- Visa or work permit

- Overseas address proof

- PAN card or PAN application proof

- Passport-size photograph

- FATCA / CRS declaration

Make sure your scans are clear and readable.

Step 4: Attestation or Notarisation (Only if Needed)

Some banks want notarised or consulate-attested papers if you are sending them from abroad. Others accept simple self-attested copies. The requirement depends on the bank and the country you live in.

Step 5: Courier the Form (If Your Bank Asks)

Banks may ask you to courier signed forms after online submission. Use a reliable courier and keep the tracking details safe. Many banks now skip this step through video KYC systems.

Step 6: Account Activation

Once the bank checks your papers, they activate the account and share your welcome kit details through email. After activation, you can fund the account using an overseas remittance.

Converting Your Resident Account to an NRI Account

If you have moved abroad for work, studies, or long-term stay, you must reclassify your resident savings account. Many people ignore this step and face problems later. Banks can freeze the account when they detect a mismatch between your stay abroad and the resident status of your account.

The steps are simple:

- Contact your bank and request status change

- Submit your passport copy and overseas address proof

- Sign the bank’s NRI reclassification form

- Add your PAN details

Once done, the bank converts the resident account into an NRO account. You can then open an NRE or FCNR(B) account if needed.

Documents Checklist You Can Copy and Use

Here is a ready list you can keep for all banks. Requirements may vary slightly, but these items cover almost every case.

- Passport (clear copy of first and last page)

- Valid visa / work permit / residence permit

- Overseas address proof (utility bill, bank statement, or rental agreement)

- PAN card or PAN application acknowledgement

- Two passport-size photographs

- NRI declaration (bank provides this)

- FATCA / CRS self-declaration

- Signed bank application form

Some banks also ask for:

- Indian address proof (optional)

- Employer ID or offer letter (rare)

- Purpose letter for NRO remittance (only needed later)

Indian Tax Rules Governing NRI Banking

Tax is an important part of NRI banking. If you guess the rules, you may lose money through wrong TDS or delayed refunds. Below is a simple breakdown.

NRE Interest

Interest on NRE accounts is normally not taxed in India for people who qualify as NRIs. This is one reason why many NRIs prefer to keep savings in NRE deposits.

NRO Interest

Interest on NRO accounts is taxed in India. Banks deduct TDS before crediting the interest. If the TDS is higher than your actual tax, you can file an Indian tax return and claim a refund.

FCNR(B) Interest

Interest on FCNR(B) deposits is normally not taxed in India for NRIs while the deposit holder remains non-resident.

Other Income in India

If you earn rent, dividends, pension, or capital gains in India, these incomes fall under Indian tax rules. The bank may deduct TDS depending on the type of income. You may also need to file a tax return if your income crosses certain limits or if you want to claim a refund.

DTAA Relief

If your home country has a tax treaty (DTAA) with India, you may be able to reduce double taxation. You can claim this relief through correct paperwork or by filing a tax return in India.

Repatriation Rules and How Much You Can Send Abroad

Repatriation means moving money from India to your overseas bank account. The rules depend on which account the money sits in. Knowing these rules helps you plan better and avoid delays.

Repatriation from NRE Accounts

Money in NRE accounts can be moved overseas without limits. Both the principal and interest can be sent to your foreign bank account at any time. There is no upper cap and no special paperwork needed other than basic bank forms.

Repatriation from FCNR(B) Deposits

FCNR(B) deposits are fully transferable. Once they mature, you can move the full amount overseas in the same foreign currency. This is one major advantage of FCNR(B) deposits, especially for people who want to avoid rupee swings.

Repatriation from NRO Accounts

NRO funds have limits. The usual ceiling is up to USD 1 million in a financial year for all types of eligible transfers. Banks will ask for a Chartered Accountant certificate, proof of the source of funds, and basic bank forms. The paperwork is not hard, but you must keep all sale deeds, rent agreements, tax payment proofs, and bank statements ready.

Repatriation of Property Sale Money

If you sell a house or land in India, you must show the sale deed, proof of tax payment, and documents that confirm your right to transfer the money. Banks look closely at these cases because the amounts are usually large. Keep clear scanned copies and originals safe until the transfer is complete.

TDS, Refunds, and How to Avoid Problems

TDS (Tax Deducted at Source) affects most NRO transactions. If you do not understand how it works, you may end up paying more tax than needed. Here is a clear breakdown.

How TDS Works on NRO Interest

Banks deduct TDS every time interest is credited in your NRO account. If this rate is higher than your final tax rate, you can claim a refund by filing an income tax return in India.

TDS on Rent, Dividends, and Property Sales

If you receive rent, the tenant may deduct TDS. Dividends usually come with some level of tax deduction depending on the company’s rules. Property sales involve separate TDS rules based on the value of the property and the type of buyer. Keep every TDS certificate safely.

How to Claim a Refund

You can claim extra TDS back by filing a return with the correct details. Make sure your PAN is updated in your bank account and all TDS entries match your Form 26AS. Incorrect entries can delay refunds.

Daily Banking and Payment Features

NRI accounts come with most facilities that resident accounts offer, but there are a few differences you should know. These small details matter when you try to pay bills or send money to family in India.

Online Banking and Mobile Banking

Most banks give full online access to NRE and NRO accounts. You can check balances, open deposits, make transfers, and pay bills from the app. Some banks allow international mobile numbers, while others prefer Indian numbers. Check this before opening an account.

International Debit Cards

Banks provide debit cards linked to NRE and NRO accounts. Charges for ATM withdrawals abroad vary by bank. Some banks add currency conversion fees. If you travel often, compare cards before taking one.

UPI Access for NRIs

UPI is now open for many NRIs through certain banks. If your bank supports UPI with an international number, you can pay bills, send money in India, and use QR codes just like any other user. Note that UPI works only with your Indian bank account, not with foreign bank accounts.

Inward and Outward Remittances

Inward remittances are simple. You can send money from your overseas account to your NRE or NRO account using SWIFT or an online remittance service. Outward remittances depend on whether the funds are in NRE, NRO, or FCNR(B). Each one follows its own rules, which I covered above.

Loans, Mortgages, and Investments for NRIs

NRIs can borrow and invest in India through specific routes. The rules are clear once you break them down. Here is what you should know before starting.

Home Loans for NRIs

Banks offer home loans to NRIs for buying property in India. You must show overseas income proof, bank statements, and passport details. The loan amount depends on your income and the bank’s policy. Repayment usually happens from your NRE or NRO account.

Loans Against Deposits

Some banks allow loans against NRE or FCNR(B) deposits. The interest rate is lower compared to regular loans because the deposit acts as security.

Mutual Funds and Stock Market Investments

NRIs can invest in Indian mutual funds with normal KYC and bank details. For stock market investments, you may need a PIS (Portfolio Investment Scheme) account through an approved broker. You must also follow rules for reporting and repatriation of sale money.

KYC, FATCA, and CRS

Banks follow strict global rules to confirm identity and tax residency. These rules protect both the bank and the account holder. If you skip these steps, your account may face restrictions.

KYC

KYC checks your identity and address. If you move homes abroad, update your address and give fresh proof. Banks may freeze parts of the account if KYC updates are pending.

FATCA

If you are a US citizen or US tax resident, the bank must report your account as per FATCA rules. You must fill a simple self-declaration form during account opening.

CRS

CRS applies to people from many countries. It confirms your tax residency. The form looks similar to FATCA and is required for all NRI accounts. Make sure you state your correct tax-residency country to avoid future trouble.

Common Mistakes and How to Avoid Them

Many NRIs lose time and money because of simple mistakes. These issues are easy to avoid once you know what causes them. Below are the most common trouble points and how you can stay clear of them.

Keeping a Resident Account After Moving Abroad

This is the single biggest mistake. A resident savings account becomes invalid when you move overseas for long-term stay. Banks can freeze the account or stop certain transactions. Convert it to an NRO account as soon as your status changes.

Mixing Resident and NRI Money

Do not mix money from India and abroad in the wrong accounts. Foreign-earned income should go to NRE. India-earned income should go to NRO. Mixing both may lead to tax trouble and delays in transfers.

Delaying PAN Updates

PAN is needed for most tax matters in India. If your PAN is not linked to your NRO account, banks can deduct higher TDS or block certain requests. Keep PAN updated across all your accounts.

Missing FATCA or CRS Forms

These forms confirm your tax residency. If you don’t submit them on time, banks may restrict withdrawals or freeze certain services. Always update these forms when the bank asks.

Not Keeping Proof of Source of Funds

NRO remittances need supporting documents. If you don’t keep rent agreements, sale deeds, or tax receipts, the outward transfer may get delayed. Save both paper and digital copies.

Wrong TDS Entries

Sometimes banks post incorrect TDS details. This can delay refunds when you file your return. Check your Form 26AS at least once a year and match it with your bank statements.

Practical Situations Most Websites Do Not Cover

There are several real-life situations that people face but most articles ignore. These issues matter a lot because they affect day-to-day banking for NRIs and foreign nationals.

Using Digital-Only Onboarding

Some banks allow full online onboarding through video KYC. This saves time, especially if sending papers from abroad is slow or costly. But check whether the bank still needs physical documents later. Each country has different rules.

UPI with International Mobile Numbers

Certain banks now let NRIs register UPI using an overseas mobile number. This is helpful for paying bills in India or sending money to family. Check the bank’s list of supported countries and any limits before depending on this feature.

Joint Accounts with Resident Indians

Yes, you can open a joint account with a resident Indian, but it often causes confusion. Tax rules differ for resident and non-resident money. If both people use the same account, the bank may treat the money differently, which affects tax and transfer requests. Think carefully before choosing this setup.

Power of Attorney vs Mandate Holder vs Nominee

A power of attorney allows someone in India to act on your behalf. A mandate holder can only do basic tasks like signing cheques or submitting forms. A nominee only receives the money if something happens to you. These roles are different and should not be mixed. If you hold property or large deposits, use clear paperwork for each role.

When You Become a Resident Again

If you move back to India for good, inform the bank. Your NRE and NRO accounts must be reclassified. FCNR deposits may run until maturity, but rules differ by bank. Update your KYC, tax details, and address once you settle in India.

Fixing Bank Errors

If the bank posts wrong entries, wrong TDS, or classifies your account wrongly, you should request a correction letter. Keep the email trail and receipts. If the bank does not correct the issue, you can escalate the matter through their grievance system or the banking ombudsman.

How to Choose the Right Bank

Choosing the right bank makes a big difference in how smooth your NRI banking experience is. The points below help you pick a bank that fits your needs.

Look for a Strong NRI Desk

Banks with a proper NRI desk offer better support, faster responses, and correct guidance on remittances, deposits, and tax-related matters.

Compare Forex Spreads

When you send money to India or back overseas, the bank applies a currency conversion rate. Some banks charge higher spreads. Compare actual rates, not just the fees.

Check Online Banking Quality

NRIs depend heavily on mobile apps and online platforms. Some banks have slow or outdated systems. Choose a bank known for stable online access.

Check Remittance Fees

Look at both inward and outward charges. Some banks offer free inward remittance but charge more for outward transfers.

Look at Support for UPI

If you need frequent payments in India, pick a bank that supports UPI for NRE and NRO accounts. It saves a lot of time.

Compare Deposit Rates

If you plan to open NRE or FCNR deposits, check the interest rates across banks. Even a small difference can affect your returns over time.

Ready Workflows You Can Follow

Below are clear workflows you can copy and use. These steps help you complete tasks without missing anything important.

Opening an NRI Account from the USA, UK, Canada, or Australia

- Choose your bank and the type of account

- Fill the online form

- Upload passport, visa, address proof, and PAN

- Complete FATCA and CRS forms

- Notarise documents if needed

- Courier signed forms if required

- Wait for activation

- Send funds from your overseas bank

Converting a Resident Account to an NRI Account

- Inform your bank about the move

- Submit passport and overseas address proof

- Sign the reclassification form

- Update PAN and KYC details

- Bank converts the account to NRO

- You may open NRE and FCNR(B) if required

Remitting Sale Proceeds of Property

- Keep the sale deed ready

- Keep proof of tax paid on capital gains

- Get a Chartered Accountant certificate

- Give bank statements showing the flow of funds

- Fill the bank’s remittance forms

- Submit identity and address proof

- Wait for bank processing

Typical Charges You Should Check Before Opening An NRI Bank Account

Different banks for non-residents have different fees. Check these items before choosing your bank:

- Inward remittance fees

- Outward remittance fees

- Currency conversion charges

- ATM withdrawal charges abroad

- Account maintenance charges

- Debit card annual fees

- NRE or FCNR deposit break charges

Comparison Of Some NRI Banks In India

| Bank | NRE Savings Rate (typical) | NRO Savings Rate (typical) | FCNR(B) Currencies (common) | Typical Inward Remit Fee (receiver) | Typical Outward Remit Fee | UPI support for NRIs (notes) | Notes |

|---|---|---|---|---|---|---|---|

| State Bank of India (SBI) | 2.50% p.a. (savings) | 2.50% p.a. (savings) | USD, GBP, EUR, AUD, CAD, JPY (and others) | Express Remit ₹250 (typical); wire DD/charges may apply (varies). | Varies by channel — typical SWIFT/telegraphic transfer markup + service charge; see branch schedule. | UPI available via SBI apps for NRI accounts — check activation rules with branch. | Largest public bank; wide branch network and NRI desk; exchange margin and intermediary fees may apply. |

| HDFC Bank | ~2.50% p.a. (savings; product variants affect rate) | ~2.50% p.a. (savings) | USD, GBP, EUR, AUD, CAD, JPY (common list) | Often shown as 0.25% of INR value (min ₹250) on some inward channels; many remittances credited free but FIRCs may carry charge. | Outward remittance fees vary (branch/online); check bank fee schedule. | HDFC supports UPI for NRE/NRO accounts; activation rules apply (mobile number rules may vary). | Strong digital banking and NRI services; fees and FD rates vary by product. |

| ICICI Bank | ~2.50% p.a. (savings) | ~2.50% p.a. (savings) | USD, GBP, EUR, AUD, CAD, JPY | Incoming wire/online inward often credited with no receiver charges by bank (sender/intermediary fees may apply). | Outward remittance (online) ₹500 (typical NRI online charge); branch/Swift fees vary. | ICICI supports UPI for NRIs (international mobile numbers supported in select countries). | Large private bank; clear online remittance processes; check broker/PIS rules for equities. |

| Axis Bank | ~2.50% p.a. (savings) | ~2.50% p.a. (savings) | USD, GBP, EUR, AUD, CAD, JPY | Inward remittance usually credited without a fixed receiver fee; intermediary charges may apply. | Outward remittance service charge approx ₹500–₹1,000 (varies by channel); SWIFT and correspondent bank fees may apply. | Axis supports UPI features; check with NRI desk for international-number activation. | Good digital remittance options (RemitMoney product in some corridors offers low/zero fees). Confirm corridor-specific offers. |

| Kotak Mahindra Bank | ~2.50% p.a. (savings) | ~2.50% p.a. (savings) | USD, GBP, EUR, AUD, CAD, JPY | Generally no fixed receiver fee for inward remittances; bank may levy FIRC or processing charges for certificates. | Outward remittance charges typically ~₹1,000 + GST or per schedule; correspondent bank fees may apply. | UPI for NRI accounts depends on bank app support; check Kotak NRI services for activation rules. | Private bank with strong retail tools; check specific fee schedule for NRI accounts and foreign-currency services. |

| IDFC FIRST Bank | Varies by balance slab (IDFC shows tiered savings rates; check NRE page). | Varies by balance slab (check NRO page) | USD, GBP, EUR, AUD, CAD, JPY | IDFC FIRST often advertises no charges to credit NRI accounts from abroad (check country corridor). | Outward remittance fees vary by channel; check their outward remittance page. | IDFC FIRST now supports UPI for NRIs using international mobile numbers in select countries (12 countries announced). | Smaller branch network but strong digital features and NRI remittance offers; good for digital-first NRIs. |

Note: Verify the above information before taking any decision because bank fees and, interest, rates change quite often.

Frequently Asked Questions (FAQs)

1. Can a foreign citizen open an NRE account in India?

Generally, NRE accounts are for Indian citizens who live abroad or persons of Indian origin. A foreign citizen with no Indian origin usually cannot open an NRE account. Check the bank’s rules in case of exceptions.

2. Is interest on NRE accounts taxable in India?

Interest on NRE accounts is normally not taxed in India for those who qualify as non-resident. Keep proof of your non-resident status with the bank.

3. Is interest on NRO accounts taxable?

Yes. Interest on NRO accounts is taxable and banks normally deduct TDS. You can file an income tax return in India to claim refunds or treaty benefits if applicable.

4. What is the main difference between NRE and NRO accounts?

NRE accounts hold money sent from abroad and are usually fully repatriable and tax-free. NRO accounts hold income earned in India and are taxable with limited repatriation subject to paperwork.

5. Can I move money from NRO to my foreign bank account?

Yes, but limits apply. The RBI allows remittance up to a set ceiling per financial year for eligible transfers. Banks ask for a CA certificate and documents showing the source of funds for large transfers.

6. What is an FCNR(B) deposit and why use it?

An FCNR(B) deposit is a fixed deposit held in foreign currency in India. It protects you from rupee swings and allows full repatriation on maturity in the same currency.

7. Do I need PAN to open an NRI account?

Many banks require PAN for tax and KYC reasons. If you don’t have PAN, ask the bank if they accept PAN application proof or PAN exemption documents.

8. Can I open an NRI account fully online?

Some banks allow full online opening through video KYC and e-KYC. Others still require notarised documents or couriered forms. Check the specific bank process for your country.

9. Can NRIs use UPI?

Yes, some banks now allow NRIs to register for UPI using an overseas mobile number. UPI still works from your Indian bank account and not directly from foreign accounts.

10. What tax forms must NRIs fill at account opening?

FATCA and CRS self-declaration forms are common. These confirm your tax residency and are required by most banks to meet reporting rules.

11. Can NRIs get home loans in India?

Yes. Banks offer home loans to NRIs with proof of overseas income, credit history, and passport details. Repayment normally happens from NRE or NRO accounts as per the bank’s rules.

12. How do I claim refund if too much TDS is deducted?

File an Indian income tax return with accurate income and TDS details. Match your TDS with Form 26AS. If the TDS is higher than your tax, you will receive a refund after processing.

13. Can a joint NRE account be held with a resident Indian?

Yes, but it creates tax and repatriation complications. Money owned by the resident co-holder may not be freely repatriable. Seek bank and tax advice before opening such accounts.

14. What documents are needed to remit sale proceeds of property?

Sale deed, proof of tax paid on capital gains, CA certificate in the bank’s prescribed format, passport copy, and bank forms. Banks may ask for additional papers depending on the case.

15. Can I keep multiple NRE or NRO accounts across banks?

Yes. You can hold multiple NRE, NRO, or FCNR(B) accounts at different banks. Maintain proper KYC and track receipts for each account.

16. What happens to FCNR deposits when I return to India?

If you become a resident again, FCNR deposits may run till maturity. Some banks allow conversion to RFC accounts. Check specific bank rules and RBI guidelines.

17. How do banks report NRI accounts to tax authorities?

Banks report account details under FATCA for US-linked accounts and under CRS for other jurisdictions. These reports go to tax authorities and may affect your tax filings abroad.

18. Can NRIs invest in mutual funds and stocks in India?

Yes. NRIs can invest in mutual funds with normal KYC. For direct equity, NRIs often use the PIS route via an approved broker. Each investment type has rules for repatriation and reporting.

19. How long does it take to open an NRI account?

It depends. If the bank allows full online KYC, you may be done in a few days. If notarisation and courier are needed, expect 2–4 weeks. Keep all documents ready to speed up the process.

20. What should I do if the bank posts wrong TDS or classifies my account wrongly?

Ask the bank for a correction letter and a corrected TDS certificate. Keep all emails and transaction receipts. If the bank does not resolve the issue, use the bank’s grievance process and, if needed, escalate to the banking ombudsman.

21. Why Banking Rules Change When You Leave India?

Once your stay abroad becomes long-term, you no longer count as a resident for banking rules. Your old resident savings account is no longer valid. You must shift it to an NRI account. If you don’t, the bank may freeze or restrict the account later. Many people face trouble only because they didn’t update their status on time.

To Summarize

Choose the account that matches where your money comes from. Use NRE for money sent from abroad and NRO for India-earned income. Consider FCNR(B) if you want to keep money in a foreign currency. Keep PAN, FATCA/CRS forms, and proof of source of funds ready to avoid delays. If you plan large transfers or property sales, get a Chartered Accountant to prepare the required certificates. Keep good records and update your bank when your residency status changes.

Sources

- Reserve Bank of India — Master Circulars and NRI guidance

- Income Tax Department — NRI and residency status rules

- State Bank of India — NRI services page

- HDFC Bank — Non Resident Indians services page

- SEBI PIS Scheme — Portfolio Investment Scheme guidance

- RBI — Rules on repatriation and NRO limits