How can NRIs repatriate investment returns from India while paying minimum or zero tax?

A lot of non resident Indian ask themselves: What Is NRI Investment Repatriation and Why Does Tax Optimization Matter? However the answer is not pretty straight forward because the NRI repatriation of capital gains is the legal process of transferring investment returns, dividends, capital gains, rental income, or other earnings from India to your foreign bank account. Tax optimization matters because without proper planning, NRIs can lose 20-30% or more of their returns to unnecessary taxation, TDS deductions, and double taxation when both India and your country of residence tax the same income.

Imagine working hard to build a portfolio of Indian investments—mutual funds yielding steady returns, rental properties generating monthly income, or stocks delivering impressive capital gains—only to watch a significant chunk disappear in taxes when you try to bring that money home. This scenario plays out for thousands of NRIs every year, not because they’re required to pay high taxes, but because they don’t understand the legal frameworks designed to protect them. According to recent data, India received a record $129.4 billion in remittances in 2024, with NRIs representing one of the world’s largest diaspora communities at 18.5 million strong. With NRI deposits standing at $158.94 billion as of August 2024, the stakes for tax-efficient repatriation have never been higher. Each percentage point saved on taxes translates to millions of dollars staying in NRI pockets rather than going to unnecessary tax payments.

The good news? India has established comprehensive frameworks through the Double Taxation Avoidance Agreement (DTAA), specific NRI account structures, and favorable repatriation rules that, when understood and utilized correctly, can dramatically reduce your tax burden. This guide breaks down exactly how to leverage these mechanisms in 2025.

Key Takeaway: Proper tax planning before repatriating investment returns can save NRIs 10-25% in taxes through strategic use of DTAA benefits, correct account selection, and understanding exemption provisions under Indian tax law.

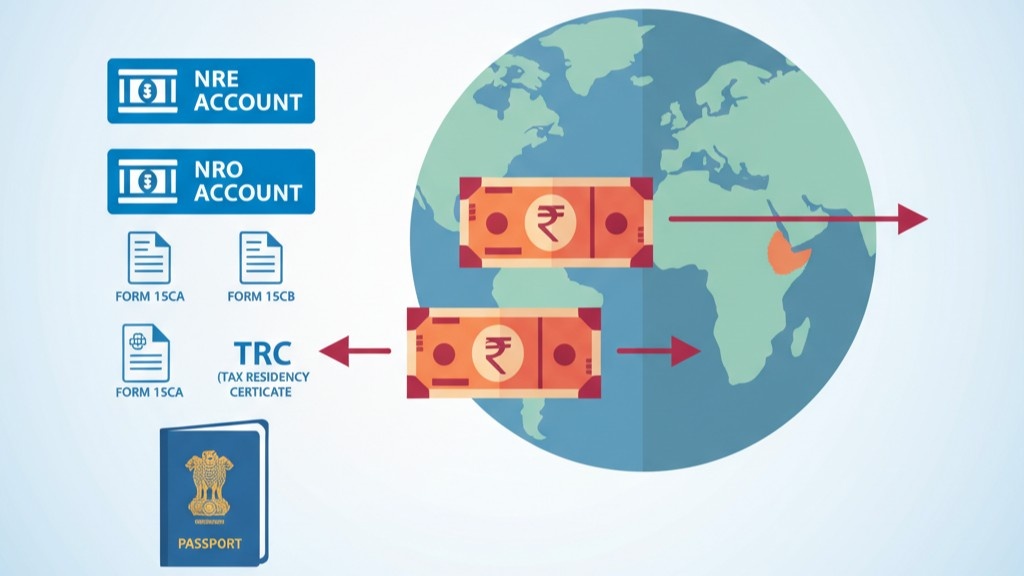

How Do Different NRI Bank Accounts Affect Repatriation Tax?

Direct Answer: Your choice of NRI bank account—NRE, NRO, or FCNR—directly impacts both your tax liability and repatriation freedom. NRE and FCNR accounts offer full repatriation with zero Indian tax on principal and interest, while NRO accounts face taxation on Indian income and have a $1 million annual repatriation limit, requiring Form 15CA and 15CB certification for fund transfers.

Understanding which account holds your investment returns is the foundation of tax-efficient repatriation. Many NRIs unknowingly pay excess taxes simply because their returns are sitting in the wrong account type. Let’s break down each account and its tax implications.

Non-Resident External (NRE) Account

An NRE account is designed for holding and managing foreign earnings with full repatriation freedom, meaning both principal and interest can be freely transferred to overseas accounts without restrictions or limitations, and both are exempt from Indian income tax.

Tax Benefits:

- Zero tax on interest earned

- No TDS deductions on interest or principal

- Complete repatriation freedom with no monetary limits

- No requirement for Form 15CA/15CB for repatriation

- Protected from currency fluctuation

Best For: Parking foreign-earned income and investment returns from repatriable investments like mutual funds purchased through NRE accounts, PIS equity investments, and overseas earnings you want to keep liquid.

Non-Resident Ordinary (NRO) Account

Unlike NRE or FCNR accounts, NRO accounts have limitations on repatriation. The current income in NRO accounts from earnings in India is liable to be taxed, with a repatriation limit of USD 1 million per financial year on income from the sale of moveable or immovable assets in India.

Tax Implications:

- Interest taxed at applicable slab rates (up to 30% plus surcharge and cess)

- TDS of 30% on rental income

- Capital gains, dividends, rental income, and pension credited to NRO accounts are taxable before repatriation

- Requires CA certification (Form 15CB) and declaration (Form 15CA) for amounts exceeding ₹5 lakh

- Annual repatriation capped at $1 million

Best For: Holding rental income, sale proceeds from Indian property, pension payments, dividends from Indian companies, and other India-sourced income.

Foreign Currency Non-Resident (FCNR) Account

The FCNR account allows you to make fixed deposit investments in foreign currency, earning tax-free interest while staying protected from currency fluctuations, with full and free repatriation of funds.

Tax Benefits:

- Interest completely tax-free in India

- No currency conversion risk

- Full repatriation without limits

- Tenure from 1 to 5 years

- No Form 15CA/15CB required

Best For: Long-term savings in foreign currency, protecting against rupee depreciation, and tax-free returns on fixed deposits.

Pro Tip: If you have rental income or capital gains sitting in an NRO account, consider the timing of your repatriation. By spreading repatriations across multiple financial years, you can maximize the $1 million annual limit while managing your overall tax liability through proper planning.

Key Takeaway: For maximum tax efficiency, route foreign-earned money and repatriable investment returns through NRE or FCNR accounts to avoid Indian taxation, and use NRO accounts only for India-sourced income that must be held there by regulation.

What Is DTAA and How Does It Prevent Double Taxation for NRIs?

Direct Answer: Double Taxation Avoidance Agreement (DTAA) is a treaty between India and over 90 countries that prevents NRIs from paying tax on the same income in both India and their country of residence. NRIs can claim tax relief through foreign tax credits, exemptions, or reduced tax rates by obtaining a Tax Residency Certificate and filing Form 10F and Form 67, potentially saving 10-25% on taxes.

Without DTAA, your income could be taxed in both countries. However, when DTAA is in effect, you will only be required to pay taxes in one country, or taxes paid in one country can be claimed as a credit in another country, avoiding double taxation per DTAA provisions.

How DTAA Works in Practice

India has signed comprehensive DTAAs with over 90 countries, including the United States, United Arab Emirates, Saudi Arabia, United Kingdom, Canada, Australia, Singapore, Germany, France, and many others. Each DTAA specifies which country has primary taxing rights for different types of income.

Three Methods to Claim DTAA Benefits:

1. Foreign Tax Credit (FTC) Method

The resident country may allow you to claim a credit for taxes already paid in the source country. Individuals who qualify as Indian residents can claim credit in India for foreign taxes paid by filing Form 67 with the income tax department.

Example: Rajesh, an NRI in the USA, earns ₹10 lakh in dividend income from Indian stocks. India withholds 20% tax (₹2 lakh). Under the India-US DTAA, the US allows him to claim this ₹2 lakh as a foreign tax credit against his US tax liability, preventing double taxation.

2. Exemption Method

Certain types of income may be entirely exempt from taxation in one country based on DTAA provisions. For instance, pension income might be taxable only in the country of residence, not in the source country.

3. Reduced Tax Rate Method

DTAA signed by India with different countries fixes a specific rate at which tax must be deducted on income paid to residents of that country. When NRIs earn income in India, the TDS applicable would be according to rates set in the Double Tax Avoidance Agreement with that country.

Step-by-Step Process to Claim DTAA Benefits

Step 1: Obtain Tax Residency Certificate (TRC)

Get a TRC from your country of residence’s tax authorities proving you’re a tax resident there. This is mandatory for claiming DTAA benefits.

Step 2: File Form 10F

Submit Form 10F electronically to the Indian Income Tax Department. This form captures details from your TRC and establishes your eligibility for DTAA benefits.

Step 3: Submit Lower TDS Certificate (Form 13)

If you want to avoid high TDS deductions at source, apply for a certificate under Section 197 from the Assessing Officer specifying lower or nil TDS rates based on DTAA provisions.

Step 4: Claim Credit When Filing ITR

When filing your Indian Income Tax Return, use Form 67 to claim credit for foreign taxes paid. Attach proof of taxes paid in your country of residence.

Did You Know? Many NRIs pay extra tax simply because they don’t know about DTAA agreements. The paperwork seems complex, but the tax savings typically run into thousands of dollars annually for moderate investment portfolios.

Key Takeaway: Always verify your country’s DTAA provisions with India before paying taxes. In many cases, you can reduce TDS from 30% to 10-15%, or eliminate it entirely by obtaining proper certifications upfront.

What Are the Most Tax-Efficient Investment Vehicles for NRIs?

Direct Answer: The most tax-efficient investment vehicles for NRIs are equity mutual funds held through NRE accounts (offering full repatriation with favorable long-term capital gains tax treatment), direct equity through Portfolio Investment Scheme (fully repatriable with indexation benefits for long-term holdings), and tax-free bonds that offer returns without any tax liability, all structured to minimize tax burden while maintaining repatriation flexibility.

Choosing the right investment vehicle is as important as choosing the right account type. Different investments face different tax treatments, and understanding these nuances can save substantial amounts during repatriation.

Repatriable Equity Investments Through PIS

NRIs can invest directly in Indian stocks listed on BSE and NSE through the Portfolio Investment Scheme (PIS). Investment under this scheme is fully repatriable for both the invested capital and any capital gains earned.

Tax Treatment:

- Short-term capital gains (holding period less than 12 months): Taxed at 15% under Section 111A

- Long-term capital gains (holding period more than 12 months): Taxed at 20% with TDS of 20% on long-term capital gains for NRIs, though NRIs can claim exemptions under Sections 54, 54EC, and 54F when filing returns

Repatriation Process: Completely repatriable through your NRE/NRO PIS-linked demat account without monetary limits.

Mutual Fund Investments

A diverse range of India-focused mutual funds cater to NRIs, with some specifically designed “NRI Mutual Funds” offering full repatriation of the invested amount and capital gains. These funds invest in various asset classes like equities, debt, or a combination of both.

Tax Benefits:

- Equity mutual funds: 10% LTCG tax on gains above ₹1 lakh (if held more than 12 months)

- Debt mutual funds: Taxed at slab rates

- Can be purchased through NRE accounts for full repatriation

- Dividend taxation: Dividend income from mutual funds is subject to 20% tax plus applicable surcharge and cess without providing deductions under Chapter VI-A

Real Estate Investments

Real estate generates returns through rental income and capital appreciation, both of which have distinct tax treatments.

Rental Income:

- NRIs must pay tax on rental income from property in India under the “Income from House Property” head, with a flat TDS of 30% applicable on rental payments under Section 195

- After paying applicable taxes with CA certificate, rental income can be legally repatriated abroad

- Standard deduction of 30% available on rental income for property repairs and maintenance

Capital Gains on Property Sale:

- Long-term capital gains (property held more than 24 months): 20% with indexation benefit

- NRIs can claim exemptions under Section 54 when profit is reinvested in residential property, or Section 54EC when invested in specified bonds like Rural Electrification Corporation or National Highway Authority bonds

Comparison Table: Investment Returns vs. Tax Efficiency

| Investment Type | Repatriation | Tax Rate (Best Case) | Tax Rate (Worst Case) | Recommended Account |

|---|---|---|---|---|

| Equity (LTCG) | Full | 10% (above ₹1L) | 20% + surcharge | NRE + PIS |

| Equity Mutual Funds | Full | 10% (above ₹1L) | 20% + surcharge | NRE |

| Debt Mutual Funds | Full | Slab rate | 30% + surcharge | NRE/NRO |

| Fixed Deposits (NRE) | Full | 0% | 0% | NRE |

| Fixed Deposits (NRO) | Up to $1M/year | Slab rate | 30% + surcharge | NRO |

| Rental Income | Up to $1M/year | 22.5% (with deductions) | 42.74% (highest slab) | NRO |

| Real Estate (LTCG) | Up to $1M/year | 20% (with indexation) | 20% + surcharge | NRO |

Key Takeaway: Structure your investment portfolio to favor NRE-account-linked equity and equity mutual funds for maximum tax efficiency and complete repatriation freedom. Use NRO accounts only for India-mandated investments like real estate rental income.

How Do Form 15CA and Form 15CB Work for NRO Repatriation?

Direct Answer: Form 15CA is a declaration you file online stating remittance details, while Form 15CB is a Chartered Accountant’s certificate confirming all applicable taxes have been paid on the amount being repatriated. These forms are mandatory when transferring more than ₹5 lakh from your NRO account to an NRE or foreign account, serving as proof of tax compliance to facilitate legal fund repatriation.

For NRIs doing NRO account outward repatriation, banks require Form 15CA and 15CB. Section 195 of the Income Tax Act provides provisions for these forms, though the section is not directly applicable on remittances by NRIs from their NRO to NRE account, banks still require these forms as mandatory documentation.

Understanding the Four Parts of Form 15CA

The furnishing of information for payment to non-residents in Form 15CA has been classified into 4 parts depending upon the case.

Part A: When remittance or aggregate remittances do not exceed ₹5 lakh during the financial year

- No CA certificate required

- Simple self-declaration sufficient

- Can be filed directly online

Part B: When remittance exceeds ₹5 lakh and you have obtained an order/certificate under Section 195(2)/195(3)/197 from the Assessing Officer

- AO has approved lower or nil deduction

- CA certificate not needed

- Requires AO order as supporting documentation

Part C: When remittance exceeds ₹5 lakh and a CA certificate in Form 15CB has been obtained

- Most common scenario for NRI repatriations

- Requires both Form 15CB from CA and Form 15CA declaration

- Used when standard tax provisions apply

Part D: When remittance is not chargeable to tax under the Income Tax Act

- For non-taxable transfers

- No CA certificate required

- Must justify why tax isn’t applicable

Step-by-Step Process for Filing Form 15CB and 15CA

Step 1: Engage a Chartered Accountant

Contact a CA registered on the e-filing portal. The CA will review your documents to certify tax compliance.

Documents Required:

- Proof of source of funds (property sale deeds, rental agreements, or investment proofs), bank statements of NRE/NRO/FCNR accounts, tax payment receipts or Form 26AS showing TDS deductions, PAN card, and passport copy

Step 2: CA Files Form 15CB

The CA logs into the e-filing portal using CA credentials, files Form 15CB certifying details of remittance to be made outside India, and e-verifies using Digital Signature Certificate (DSC).

The Form 15CB includes:

- Nature and purpose of remittance

- Tax deduction details

- DTAA applicability (if any)

- Confirmation that taxes are paid or nil tax is applicable

- CA’s professional certification

Step 3: You File Form 15CA

After the CA submits Form 15CB, you can either accept or reject Form 15CA. If you accept, you’ll enter remaining details including remitter information, remittee information, and remittance details, then e-verify using DSC or EVC.

Step 4: Submit to Bank

Once both forms are successfully filed and verified, download copies of:

- Acknowledged Form 15CA

- Certified Form 15CB

- Form 26AS (tax credit statement)

Submit these documents to your bank along with your repatriation request.

Step 5: Bank Processes Repatriation

The bank verifies all documents, ensures RBI compliance, and processes your fund transfer to your NRE or foreign account.

Common Scenarios Where Form 15CA/15CB Are NOT Required

According to Rule 37BB, Form 15CA and 15CB are not required for certain transactions, including: remittances by individuals that don’t require RBI prior approval, payments for imports, remittances under the Liberalized Remittance Scheme for personal purposes, and 33 specified payment types.

Exempted Remittances Include:

- Transfers between your own NRE accounts at different banks

- Foreign travel expenses under LRS

- Gifts to relatives abroad

- Maintenance of close relatives

- Medical treatment expenses

- Education expenses (under specific conditions)

Important: If you fail to furnish Form 15CA and 15CB before making remittance to a non-resident when required, you shall be liable to penalty provisions under Section 271I of the Income Tax Act, with penalties up to ₹1 lakh for non-compliance or inaccurate information.

Pro Tip: Start the Form 15CA/15CB process at least 2-3 weeks before you need the funds abroad. The CA certification, form filing, and bank processing can take time, especially during peak periods like financial year-end.

Key Takeaway: Form 15CA and 15CB are not obstacles but compliance tools that actually facilitate smooth repatriation. Maintain organized records of all income sources, tax payments, and deductions throughout the year to make this process seamless.

What Capital Gains Tax Exemptions Can NRIs Leverage?

Direct Answer: NRIs can leverage three major capital gains tax exemptions: Section 54 (exemption when reinvesting property sale proceeds in another residential property within specified timeframes), Section 54EC (exemption when investing capital gains in specified bonds like REC or NHAI within 6 months), and Section 54F (exemption for non-property assets when proceeds are invested in residential property), potentially eliminating tax on long-term capital gains entirely through strategic reinvestment.

Understanding capital gains exemptions is crucial because real estate and equity investments often generate the largest repatriable amounts for NRIs. These exemptions, when properly utilized, can save lakhs in taxes.

Section 54: Property-to-Property Exemption

Eligibility: Available to NRIs when they sell a residential property and reinvest the capital gains in another residential property

How It Works:

- Sell a residential house property held for more than 24 months

- Purchase or construct one residential house in India

- Purchase within 1 year before or 2 years after sale, OR

- Construct within 3 years after sale

- Complete exemption if entire capital gains are reinvested

- Proportionate exemption if partial reinvestment

Example: Priya, an NRI in Canada, sells her Mumbai apartment for ₹2 crore with a capital gain of ₹80 lakh. Normal tax would be ₹16 lakh (20%). Instead, she purchases a new property in Pune for ₹1 crore within one year. By claiming Section 54 exemption, she saves ₹16 lakh in taxes entirely.

Important Conditions:

- Cannot sell the new property within 3 years or exemption is reversed

- Can purchase only ONE residential house (not multiple units)

- Property must be in India (foreign property doesn’t qualify)

Section 54EC: Bonds Exemption

The exemption under Section 54EC has been restricted to capital gain arising from transfer of long-term capital assets being land and building. The investment must be made within 6 months in bonds eligible for exemption, which are Rural Electrification Corporation Limited (REC bonds) and National Highways Authority of India bonds.

Key Features:

- Maximum investment limit: ₹50 lakh per financial year

- Lock-in period: 5 years (bonds cannot be sold or used as collateral)

- Interest earned is taxable

- No indexation benefit on bonds

- Simple and quick process

Strategic Use: Ideal when you don’t want to purchase another property but want to defer tax liability. The ₹50 lakh limit means this works best for moderate capital gains.

Section 54F: Other Assets to Property Exemption

Eligibility: When you sell long-term capital assets OTHER than residential property (like stocks, mutual funds, gold, or land) and invest proceeds in residential property.

How It Works:

- Sell any long-term capital asset (not residential house)

- Invest in ONE residential house property

- Purchase within 1 year before or 2 years after sale

- Construction within 3 years after sale

- Critical: Must not own more than one residential house on the date of transfer

Calculation Formula: Exemption = Capital Gain × (Investment in New Property / Net Sale Consideration)

Example: Ramesh, an NRI in Singapore, sells mutual fund units with ₹50 lakh capital gains (net consideration ₹80 lakh). He invests ₹60 lakh in a new residential property. His exemption: ₹50L × (₹60L/₹80L) = ₹37.5 lakh. He pays tax only on the remaining ₹12.5 lakh.

Pro Tip: Section 54F calculations are based on net consideration (total sale amount), not just capital gains. This means you need to invest a larger portion of your sale proceeds to get full exemption compared to Section 54.

Section 115F: Exemption on Foreign Asset Transfer

Special Provision for NRIs: NRIs are exempted from taxes on long-term capital gains from the sale or transfer of specified foreign exchange assets acquired in India through inward remittance in foreign currency, provided the profit is reinvested into other specified assets.

Specified Assets Include:

- Shares or debentures of Indian companies

- Deposits with Indian banks

- Government securities

- National Savings Certificates

- Other specified government investments

Key Advantage: No indexation benefit available, but complete exemption possible through reinvestment. This is specifically designed to encourage NRIs to keep rolling over investments in India.

Comparison Table: Capital Gains Exemptions

| Section | Asset Sold | Reinvestment Required | Time Limit | Maximum Benefit |

|---|---|---|---|---|

| 54 | Residential property | Residential property | 1 year before to 2 years after (purchase) or 3 years (construction) | Complete exemption |

| 54EC | Land/building | Specified bonds (REC/NHAI) | 6 months | Up to ₹50 lakh |

| 54F | Non-property assets | Residential property | Same as Section 54 | Proportional to investment |

| 115F | Foreign exchange assets | Specified Indian assets | As per asset type | Complete exemption |

Key Takeaway: Plan your asset sales and purchases strategically. If you’re selling an Indian property, line up a replacement property within the eligible timeframe to claim Section 54. If buying property isn’t in your plans, Section 54EC bonds offer a quick alternative for up to ₹50 lakh in gains.

How Can NRIs Optimize TDS Deductions on Indian Income?

Direct Answer: NRIs can optimize TDS deductions by obtaining a Lower TDS Certificate (Form 13) under Section 197, providing Form 15G/15H declarations where applicable, ensuring correct PAN linking to avoid higher 20% TDS rates, claiming foreign tax credits through DTAA, and filing income tax returns annually to claim refunds on excess TDS deducted, potentially recovering 10-20% of your gross income.

Tax Deducted at Source (TDS) is often the biggest immediate tax burden for NRIs. Understanding how to minimize it legally is essential.

Understanding TDS Rates for NRIs

Standard TDS Rates:

- Salary: As per slab rates

- Interest on bank deposits (NRO account): 30%

- Interest on securities: 30%

- Rental income: 30%

- Dividends: 20%

- Long-term capital gains: 20%

- Short-term capital gains (equity): 15%

- Professional/technical fees: 10%

The Problem: These rates don’t account for deductions, exemptions, or DTAA benefits you’re entitled to. Money gets locked up in TDS, requiring you to file returns and wait months for refunds.

Method 1: Lower TDS Certificate (Form 13)

What It Is: A certificate issued by the Assessing Officer under Section 197 authorizing payers to deduct tax at a lower rate or nil rate based on your estimated total income and tax liability.

When to Use:

- Your actual tax liability is lower than standard TDS rates

- You have DTAA benefits that reduce tax rates

- You have significant deductions under Chapter VI-A

- Your income falls in lower tax slabs

Application Process:

- File Form 13 online on the income tax e-filing portal

- Provide estimated income and tax computation for the financial year

- Submit supporting documents (DTAA certificate, past ITRs, proof of deductions)

- AO reviews and issues certificate valid for one financial year

- Submit certificate to payer (employer, tenant, bank, company)

Example: Anjali, an NRI in Dubai, earns ₹6 lakh rental income annually. Standard TDS: 30% = ₹1.8 lakh. After 30% standard deduction, her taxable rental income is ₹4.2 lakh. With basic exemption and other deductions, her actual tax liability is ₹45,000. By obtaining Form 13, she reduces TDS to 10%, locking up only ₹60,000 instead of ₹1.8 lakh, improving her cash flow dramatically.

Method 2: Correct PAN Linking

Critical Requirement: If PAN is not linked with Aadhaar, the PAN becomes inoperative, resulting in TDS being deducted at 20% instead of applicable rates.

Action Items:

- Ensure your PAN is linked to Aadhaar (even as NRI, if you had Aadhaar)

- Provide PAN to all payers (banks, tenants, companies)

- Update PAN in all your investment accounts

- Quote PAN in all transactions

Impact: Difference between 20% (inoperative PAN) vs. 10-15% (correct rate) on a ₹10 lakh transaction = ₹50,000-1,00,000 saved.

Method 3: Tax Residency Certificate for DTAA

Process:

- Obtain TRC from your country of residence

- File Form 10F on Indian tax portal

- Provide TRC and Form 10F to payers

- Payers apply DTAA rates instead of standard rates

Impact Example: Under India-Singapore DTAA, interest income is taxed at 15% instead of 30%. On ₹5 lakh interest income, you save ₹75,000 (30% – 15% = 15% of ₹5L).

Method 4: Strategic Timing of Income

Technique: Structure receipt of income to spread across financial years or time it when you have offsetting deductions.

Strategies:

- Defer property sale to a year when you have Section 54 reinvestment planned

- Stagger mutual fund redemptions across financial years

- Time dividend distributions to match with available exemptions

- Align rental agreements to start in months that optimize your tax year

Method 5: File ITR Even If Not Mandatory

Why File When Not Required?

- Claim refund of excess TDS deducted

- NRIs can claim refund of excess TDS deducted from capital gains at the time of return, especially when they’ve invested in specified bonds or properties qualifying for exemptions

- Establish clean tax record for future transactions

- Required for certain financial applications

Refund Process:

- File appropriate ITR form (usually ITR-2 for NRIs)

- Declare all income and claim deductions/exemptions

- System automatically calculates refund based on TDS vs. actual tax liability

- Refund credited to bank account within 1-6 months

Pro Tip: The due date for filing returns for NRIs is typically July 31st, but for FY 2024-25, the deadline has been extended to September 15, 2025. File early to get refunds faster.

Key Takeaway: TDS is just an advance tax payment, not your final tax liability. Between Form 13 for lower deductions, DTAA certificates for reduced rates, and annual ITR filing for refunds, you can recover significant amounts locked in TDS.

What Are the Latest 2025 Changes Affecting NRI Repatriation?

Direct Answer: The Income Tax Bill 2025 proposes to simplify NRI taxation by consolidating provisions, maintaining RNOR status benefits for those earning above ₹15 lakh, introducing stricter Place of Effective Management (POEM) rules, exempting NRIs from filing returns if TDS is deducted on eligible income, and allowing capital gains tax exemptions for reinvestments—all designed to make tax compliance easier while strengthening measures against tax evasion.

Staying updated with the latest changes is crucial for tax planning. The year 2025 brings significant reforms that impact how NRIs manage their Indian investments.

Income Tax Bill 2025: Key Highlights for NRIs

India’s central government introduced the Income Tax Bill 2025 to replace the six-decade-old Income Tax Act of 1961, simplifying the tax structure by consolidating 47 chapters into 23 and reducing 819 sections to 536 clauses, making tax compliance easier for NRIs.

Major Changes:

Simplified Residential Status Determination: Critical clauses include Clause 5, which defines the scope of income for residents and non-residents, and maintains existing provisions for Indian citizens leaving for employment or ship crew members with different residency criteria.

RNOR Status Retained: If you earn more than ₹15 lakh in India, your global income will remain untaxed in India under RNOR status, providing continued protection from worldwide income taxation.

No Return Filing in Specific Cases: NRIs may not need to file returns if their only income is investment income or long-term capital gains and TDS is already deducted, reducing compliance burden for passive investors.

Capital Gains Exemptions Maintained: NRIs who reinvest long-term capital gains in specified assets within six months can claim exemption from capital gains tax, with partial exemption if reinvestment is less than the proceeds.

Stricter POEM Rules: The Bill strengthens Place of Effective Management rules to ensure foreign companies with significant operations in India are taxed accordingly, affecting NRIs with business interests.

New Tax Regime vs. Old Tax Regime

Default Change: The Finance Act 2024 amended Section 115BAC to make the new tax regime the default for individuals, HUF, AOP, BOI, or Artificial Juridical Person, though eligible taxpayers can opt out and choose the old tax regime by furnishing Form 10-IEA.

Comparison for NRIs:

New Tax Regime:

- Lower tax rates (0% up to ₹3 lakh, 5% from ₹3-7 lakh, etc.)

- No deductions under Chapter VI-A (80C, 80D, etc.)

- Standard deduction of ₹50,000 available

- Simpler calculation

Old Tax Regime:

- Higher tax rates (0% up to ₹2.5 lakh, 5% from ₹2.5-5 lakh, etc.)

- All deductions available (80C up to ₹1.5 lakh, 80D, 24(b), etc.)

- More complex calculation

- Better if you have significant deductions

For NRIs: Choose based on your investment pattern. If you have large Section 80C investments, home loan interest, or health insurance, the old regime might still be beneficial.

TCS on Foreign Remittance Updates

As of April 2025, TCS rates are: Nil to 5% for education/medical expenses, 5-20% for tour packages, 20% for other remittances above ₹10 lakh, with exemptions for education loans under Section 80E, education/medical expenses up to ₹10 lakh, and overseas credit card spends until further notice.

NRI-Specific Relief: According to Section 206C(1G), there is no applicable TCS when NRIs transfer money from their NRO to NRE account, allowing NRIs to remit their Indian income like salary, dividends, business profits, and rent via NRO accounts without TCS burden.

Digital Compliance Enhancements

Mandatory Online Filing: Since 2021, Form 15CA/CB filings must be fully online using DSC or EVC; manual submission is not permitted, ensuring faster processing and better tracking.

Annual Information Statement (AIS): All financial transactions are now reported in AIS, making it easier for tax authorities to track income but also simpler for you to verify all your income sources and TDS deductions in one place.

Key Takeaway: The 2025 changes generally simplify compliance and maintain tax benefits for NRIs. Stay informed about these changes and adjust your tax strategy accordingly, particularly around return filing requirements and choosing between old and new tax regimes.

What Common Mistakes Should NRIs Avoid During Repatriation?

Direct Answer: The most common mistakes NRIs make during repatriation include holding India-sourced income in wrong account types (NRE instead of NRO), not obtaining DTAA certificates before TDS deduction, missing Form 15CA/15CB filing deadlines, failing to claim capital gains exemptions through timely reinvestment, neglecting to file ITR for TDS refunds, and not documenting the source of funds properly—errors that collectively cost NRIs millions in unnecessary taxes and penalties annually.

Learning from others’ mistakes is cheaper than making them yourself. Here are the most expensive repatriation errors and how to avoid them.

Mistake 1: Wrong Account Selection for Income Type

The Error: Routing rental income or property sale proceeds to an NRE account, or keeping foreign earnings in an NRO account.

Why It’s Costly: Income from rent and property sales must go to NRO accounts, while NRE accounts are for foreign-earned income. Mixing these up can lead to regulatory violations, account freezing, and complications in repatriation.

Solution:

- Open and maintain separate NRE and NRO accounts

- Direct all India-sourced income (rent, dividends, property sales) to NRO

- Keep all foreign salary, business income, and investment returns in NRE

- Review account statements quarterly to catch any misrouting

Mistake 2: Not Planning Capital Gains Reinvestment in Advance

The Error: Selling property or assets without having a reinvestment plan, then scrambling to find qualifying investments within the deadline.

Why It’s Costly: Section 54 requires property purchase within 1 year before or 2 years after sale, or construction within 3 years. Section 54EC bonds must be purchased within 6 months. Missing these deadlines means paying full 20% tax on capital gains.

Real Example: Suresh sold his Delhi property with ₹1 crore capital gain in March 2024, intending to buy another property “soon.” He got busy with work overseas, started property hunting in November 2024, but couldn’t finalize a purchase until April 2026—missing the 2-year window. Result: ₹20 lakh tax liability that could have been completely avoided.

Solution:

- Start property search BEFORE selling, not after

- For Section 54EC, keep bonds application process ready

- Set calendar reminders at 1 month before deadline

- Consider Section 54EC bonds as backup if property search isn’t successful

Mistake 3: Ignoring DTAA Benefits

The Error: Allowing 30% TDS deduction without claiming DTAA reduced rates or foreign tax credits.

Why It’s Costly: DTAA can reduce tax rates from 30% to 10-15% for many income types. Not claiming these benefits means overpaying taxes by 15-20 percentage points.

Example: Meera, an NRI in the UAE, earned ₹8 lakh interest income on NRO deposits. She paid 30% TDS = ₹2.4 lakh. India-UAE DTAA allows only 12.5% tax on interest. By not claiming DTAA benefits, she overpaid ₹1.4 lakh annually.

Solution:

- Research your country’s DTAA with India annually

- Obtain TRC well before financial year begins

- File Form 10F proactively

- Provide DTAA documentation to all payers upfront

Mistake 4: Poor Documentation of Fund Sources

The Error: Not maintaining clear paper trails for the source of funds being repatriated, especially for large amounts.

Why It’s Costly: Banks require proof of source of funds such as property sale deeds, rental agreements, investment proofs, and clear documentation for Form 15CA/15CB processing. Without proper documentation, repatriation requests get delayed or rejected.

Solution:

- Maintain digital and physical copies of all investment documents

- Keep all sale deeds, purchase receipts, and transfer proofs

- Organize documents by financial year and income type

- Create a “repatriation folder” with all required documents ready

Mistake 5: Not Filing ITR Despite Excess TDS

The Error: Assuming that since TDS was deducted at source, no further action is needed.

Why It’s Costly: You leave lakhs of rupees as refunds unclaimed with the government. NRIs can claim refund of excess TDS deducted at the time of return, especially when they’ve utilized exemptions under Sections 54, 54EC, or 54F.

Statistics: Thousands of NRIs have unclaimed refunds totaling hundreds of crores, simply because they didn’t file returns assuming “TDS already paid means compliance complete.”

Solution:

- File ITR every year, even if income seems below taxable limit

- Track TDS in Form 26AS throughout the year

- Claim all deductions and exemptions

- Follow up on refund status until money is credited

Mistake 6: Last-Minute Repatriation Attempts

The Error: Deciding to repatriate large amounts close to when you need the money abroad, without considering processing timelines.

Why It’s Costly: Form 15CB certification, Form 15CA filing, bank verification, and actual fund transfer can take 2-4 weeks. Urgent situations lead to errors, penalties, or missed opportunities.

Solution:

- Plan repatriations at least 30 days in advance

- Stagger large repatriations across quarters

- Maintain liquidity in both Indian and foreign accounts

- Build a repatriation calendar for the year

Mistake 7: Exceeding Annual Repatriation Limits

The Error: Attempting to repatriate more than $1 million from NRO accounts in a single financial year without RBI approval.

Why It’s Costly: Up to USD 1 million can be repatriated per financial year across all NRO bank accounts held by an NRI. For repatriation above USD 1 million, you need RBI approval. Without approval, transactions get blocked.

Solution:

- Track cumulative repatriation from ALL NRO accounts

- If expecting large sums, apply for RBI approval early

- Consider spreading repatriation across two financial years

- Use NRE accounts for larger amounts when possible

Key Takeaway: Most repatriation mistakes stem from poor planning and incomplete knowledge. A simple checklist reviewed quarterly—covering account types, deadlines, documentation, and limits—prevents 90% of these costly errors.

How Should NRIs Structure Multi-Year Repatriation Strategy?

Direct Answer: NRIs should structure multi-year repatriation strategy by diversifying holdings across NRE, NRO, and FCNR accounts based on income sources, staggering large repatriations across financial years to stay within annual limits, timing asset sales to align with tax-saving reinvestment opportunities, maintaining 18-24 months of planned repatriation documentation ready, utilizing DTAA benefits consistently, and coordinating tax planning with both Indian and foreign tax years—all while keeping 10-15% liquidity buffer for unexpected needs.

Strategic multi-year planning transforms repatriation from a reactive scramble into a wealth-optimization tool.

The Strategic Framework

Year 1: Setup and Optimization

Actions:

- Audit all existing Indian accounts and investments

- Restructure holdings to correct account types (move to NRE/NRO as appropriate)

- Obtain TRC and file Form 10F for DTAA benefits

- Apply for Form 13 lower TDS certificate if applicable

- Document all investment sources and create digital archive

Financial Impact: This foundational year might show minimal repatriation but saves 20-30% on taxes in subsequent years through proper structuring.

Year 2-3: Steady State Repatriation

Actions:

- Repatriate within $1 million NRO limit annually

- Time mutual fund redemptions and dividend receipts

- File ITRs by July/September deadline to claim refunds from Year 1

- Review and renew Form 13 certificates

- Maintain rolling 12-month repatriation calendar

Strategy Example:

Q1 (Apr-Jun): Repatriate $250,000 from NRO (prior year’s rental income) Q2 (Jul-Sep): Redeem equity mutual funds worth $300,000 from NRE Q3 (Oct-Dec): Transfer $200,000 dividends and interest from NRO Q4 (Jan-Mar): Repatriate $250,000 from property rental income

Total Annual Repatriation: $1 million (within limits) spread across quarters for better cash flow management.

Year 4+: Major Asset Liquidation Planning

Actions:

- Plan property sales 18-24 months in advance

- Identify Section 54/54EC/54F opportunities

- Structure sales across financial years if proceeds exceed $1 million

- Apply for RBI approval if needed for larger amounts

- Consider OCI status conversion if returning permanently

Example Multi-Year Property Strategy:

Year 4: Sell Property A ($800K proceeds) → Claim Section 54 by buying Property B Year 5: Sell Property B ($1.2M proceeds) → Repatriate $1M, retain $200K for next year Year 6: Complete final repatriation of remaining $200K + accumulated rental income

Tax Year Coordination Strategy

Critical Consideration: Your foreign country’s tax year may not align with India’s financial year (April-March).

US NRIs: US tax year is January-December. Plan repatriations in January-March to ensure income is recognized in the correct US tax year for foreign tax credit claims.

UK NRIs: UK tax year is April-March (same as India), making coordination simpler.

Middle East NRIs: Most Gulf countries have no personal income tax, simplifying planning to focus only on Indian tax obligations.

Creating Your Personal Repatriation Roadmap

Step 1: Three-Year Projection

Create a spreadsheet with:

- Projected income by source and account type

- Expected investment maturities

- Planned asset sales

- Estimated tax liability and TDS

- Month-by-month repatriation targets

Step 2: Quarterly Review Cycle

Set four annual review dates:

- April: Review prior year’s ITR filing, plan coming year’s repatriation

- July: Mid-year check on repatriation progress, file ITR

- October: Q3 review, adjust strategy for final quarter

- January: Year-end closeout, finalize December repatriations

Step 3: Professional Advisory

Engage:

- Indian CA for ITR filing, Form 15CB, and tax advisory

- Foreign tax advisor for DTAA optimization and foreign tax credits

- Investment advisor for portfolio rebalancing and repatriation timing

- Legal counsel for large property transactions

Cost vs. Benefit: Professional fees of ₹50,000-1,00,000 annually can save ₹5-10 lakh+ in optimized tax planning.

Key Takeaway: Multi-year repatriation strategy is like a financial chess game—you’re planning several moves ahead. The NRIs who save the most taxes are those who treat repatriation as a continuous strategic process, not a one-time transaction.

FAQ: NRI Investment Repatriation and Tax Optimization

What is the maximum amount an NRI can repatriate from India in a year?

NRIs can repatriate up to USD 1 million per financial year from NRO accounts. There are no limits on repatriation from NRE and FCNR accounts. For amounts exceeding $1 million from NRO accounts, you must obtain prior RBI approval. The $1 million limit applies cumulatively across all NRO accounts held by the NRI, not per account.

Do NRIs have to pay tax twice on the same income?

No, thanks to DTAA. India has signed Double Taxation Avoidance Agreements with over 90 countries to prevent NRIs from paying tax twice on the same income. NRIs can claim benefits through foreign tax credits, exemptions, or reduced tax rates by obtaining a Tax Residency Certificate and filing the required forms. You’ll pay tax in one country and claim credit in the other, or pay at a reduced rate in the source country.

Is Form 15CA/15CB required for every repatriation from NRO to NRE account?

Form 15CA is required when transferring funds exceeding ₹5 lakh in a financial year (single transaction or aggregate). Part A suffices for amounts below ₹5 lakh. For amounts exceeding ₹5 lakh, Form 15CB from a CA and Form 15CA Part C are required. However, certain transactions are exempt from this requirement under Rule 37BB.

Can NRIs avoid TDS on bank interest in India?

Yes, partially. Interest from NRE and FCNR accounts is completely tax-free with no TDS. For NRO accounts, TDS is deducted, but NRIs can obtain a lower TDS certificate under Section 197 if their actual tax liability is lower than the standard 30% TDS rate. You can also claim refund of excess TDS by filing an income tax return.

What happens if I don’t file Form 15CA before repatriating funds?

Failure to furnish Form 15CA before making remittance when required can result in penalty provisions under Section 271I of the Income Tax Act, with penalties up to ₹1 lakh for non-compliance or furnishing inaccurate information. Additionally, banks will not process your repatriation request without Form 15CA/15CB documentation.

How long does the repatriation process take from NRO to foreign account?

The complete process typically takes 2-4 weeks, depending on documentation completeness:

- CA certificate preparation: 3-5 days

- Form 15CB and 15CA filing: 1-2 days

- Bank verification and processing: 7-14 days

- International transfer: 2-5 days

Start the process at least 30 days before you need funds to account for potential delays or documentation issues.

Can I repatriate rental income from India?

Yes. After paying applicable taxes with a Chartered Accountant’s certificate, rental income can be legally repatriated abroad. Rental income is taxed at applicable slab rates (up to 30% plus surcharge), with a standard deduction of 30% available for repairs and maintenance. TDS of 30% is deducted by tenants, which can be adjusted against your final tax liability when filing ITR.

Is interest from NRE fixed deposits taxable in India?

No, both the principal amount and interest earned on NRE accounts are exempt from Indian income tax and can be freely repatriated to overseas accounts without any restrictions or limitations. This makes NRE fixed deposits one of the most tax-efficient investment options for NRIs parking foreign-earned money in India.

In Summary: Your Action Plan for Tax-Efficient Repatriation

The complexity of NRI investment repatriation and tax optimization shouldn’t be overwhelming—it should be empowering. With the right knowledge and strategic approach, you can legally minimize your tax burden while efficiently transferring your hard-earned investment returns home.

The main point is: Success in NRI repatriation comes down to three pillars: (1) choosing the correct account types for your income sources, (2) leveraging DTAA benefits and capital gains exemptions proactively, and (3) maintaining meticulous documentation and planning repatriations well in advance. These three practices alone can save 15-30% in unnecessary taxes.

Key Actions to Implement Today:

Immediate Actions (This Week):

- Audit your current NRI accounts and investment holdings

- Verify your PAN is linked with Aadhaar and is operative

- Gather documentation for all Indian income sources

- Check your country’s DTAA provisions with India

Short-Term Actions (This Month):

- Obtain Tax Residency Certificate from your country of residence

- File Form 10F on the Indian tax portal

- Calculate your cumulative NRO repatriation for the current financial year

- Apply for Form 13 Lower TDS Certificate if your tax liability is lower than standard rates

Medium-Term Actions (This Quarter):

- Restructure investments to appropriate account types

- Create a 12-month repatriation calendar

- Engage a CA familiar with NRI taxation

- File any pending ITRs to claim TDS refunds

Long-Term Strategic Actions:

- Develop a 3-5 year repatriation roadmap

- Plan major asset sales 18-24 months in advance

- Identify Section 54/54EC reinvestment opportunities

- Build relationships with tax advisors in both countries